Business is often the dream and baby of young entrepreneurs. But what happens when ideas start bearing fruit, your enterprise starts to resolve real-world problems, and your baby starts walking initial steps?

You realize the need to ‘nurture’ your child; you need better resources hired, financial backing to experiment (R&D) and compete in a highly competitive market.

Startups are often described as sailing on high-speed ships. Luckily, venture capital can prove to be a captain’s compass – helping you steer through the choppy waters of growth with confidence. It won’t just help you stay afloat; it prepares your business to dock at the right ports, from product-market fit to financial audits, and ultimately, VC boardrooms!

A Roadmap to Venture Capital-Backed IPO

Venture capital is a type of private equity that can be later taken public via initial public offering. Such a company is called VC-backed IPO. VC funding is offered by investors to organizations with big-ambitions and high-growth potential and later this investment can be maximized by venture capitalists strategically to recover their investments. Venture capitalists usually invest in early-stage businesses for a equity stake, assuming the startup will eventually reap profits and become successful.

But, how can startups you secure VC funding? Is it a piece of cake? No, your business needs to be prepared. When you’re aiming for venture capital funding, you cannot afford to just grow; you need controlled growth. How do you do that?

Chart a Startup Course Investors Want to Be Part Of

While enthu takes you halfway, investors are looking for that ‘credibility,’ ‘compliance,’ and ‘clarity’ that prove you’re not just building fast, but building right.

With SAP Business One, you show that your startup isn’t just about passion; it’s backed by processes, real-time reporting, strong financial hygiene, and growth readiness. It becomes easier to demonstrate your revenue flow, customer traction, operational discipline, and a vision that’s rooted in data, not just dreams.

From day one, SAP B1 helps you run like a company that’s already investor-backed: structured, agile, and fund-ready.

Here’s how SAP Business One can give your startup an edge on the fundraising trail:

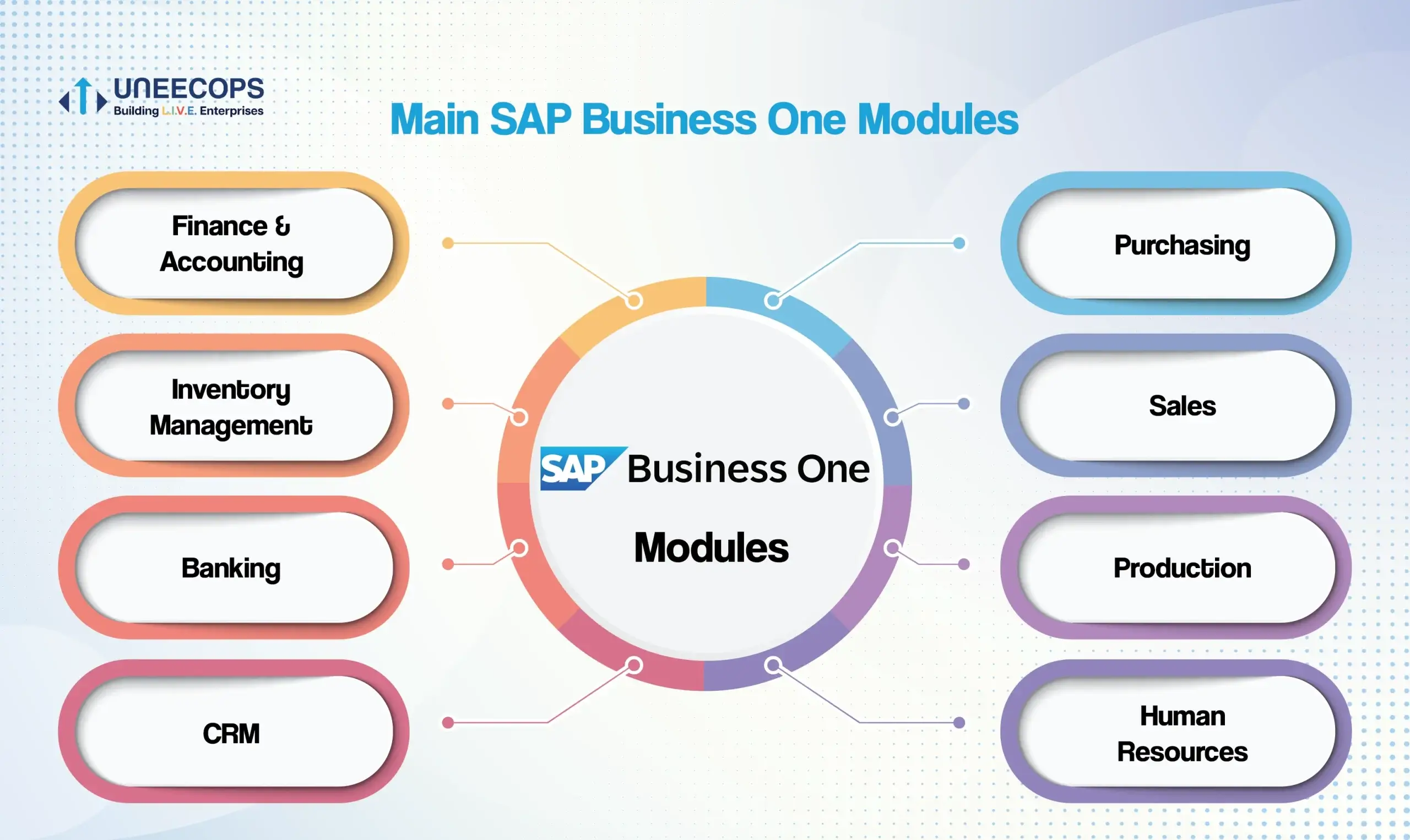

1. Order from Day Zero: Startups running spreadsheets or legacy tools often face reporting delays and financial inaccuracies. SAP Business One unifies all your workflows, from finance, inventory, to supply chain, making sure your books are clean, auditable, and investor-ready from the beginning.

2. Mandatory Compliance in the Digital Era: When VCs do their due diligence, they look for red flags. SAP Business One ensures you’re GST-compliant, maintaining accurate tax records, financial reports, and audit trails, making it easier to pass investor scrutiny.

3. Real-time Dashboards, Not Promises: Investors want to see real traction on customer acquisition, recurring revenue, margins, etc. SAP Business One helps you present live dashboards, revenue forecasts, and real-time reports to back up your pitch with hard data.

4. Earn Investors Trust with Assured ROI Predictions: VCs invest in scale-ready businesses, not mere ideas. SAP Business One provides the infrastructure to grow, from managing procurement data to expanding teams or geographies, making your startup appear built for the long run.

5. Strategic Planning and Smart Storytelling: When pitching, it’s not just about what you’re doing, but how you’re thinking ahead. SAP B1 empowers you with scenario planning, budgeting, and resource forecasting, helping you craft a story that’s not just visionary, but viable.

6. Professionalism Signals Commitment: Implementing a global-grade ERP system like SAP Business One shows VCs that you are committed to building a serious business, not a hobby project. It demonstrates that you’re investing in your processes as much as your product.

SAP Business One (SAP B1) Isn’t a VC’s Checklist Item; It Can Be Your Silent Early Mover Advantage in Building Credibility and Scalability

VCs may not ask if you’re using SAP B1, but they’ll notice what it enables. Transparent reporting, structured growth, and strategic foresight: these are the intangibles that tilt investor decisions in your favor.

If you’re dreaming of Series A (or beyond), maybe it’s time to lay the right foundation with SAP Business One and build the traits of credibility that VCs respect, invest in, and can’t say no to.

Already thinking long-term? Don’t miss our take on how SAP evolves with your business: from startup seed to global scale.

Looking to begin? Partner with SAP Platinum Partner Uneecops to implement SAP Business One. This 2025, get your startup’s early mover advantage in building investor-ready credibility, compliance, and clarity!