Forging Futuristic FinTechs

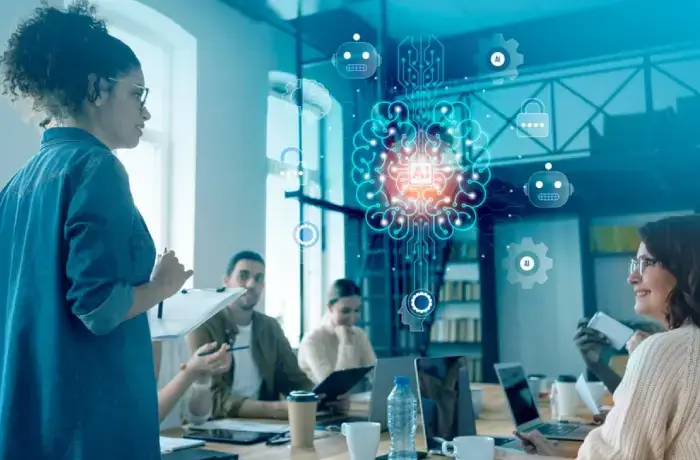

Futureproofing fintech with tech is how we help our clients navigate financial markets, enhance portfolios, and make strategic decisions. Our comprehensive solutions create a lean and agile ecosystem, empowering clients to embrace future readiness. Through our expertise in data science, data engineering, and visualization, we facilitate business scalability, risk reduction, and customer retention.

FinTech Roadblocks

With accelerated technology adoption and innovation, furthered by the entry of new-age competitors, the task at hand for Fintechs is to tackle critical structural issues plaguing the financial services sector—enhancing outreach, elevating customer experience, minimizing operational friction, and propelling the adoption of digital channels.

Fueling Success: Fintech's Analytical

Automation in Action

Uneecops’ advanced analytics solutions help Fintech firms with marketing, customer experience, and risk mitigation. Our business intelligence solutions power real-time decision-making to identify new revenue opportunities, improve efficiencies and reduce risk.

Strategies that help FinTechs automate

with advanced analytics

With the right technology, strategy, data, and level of agility, we enable fintech companies to churn profitable growth in an ever-changing and challenging world.

Establish an analytics strategy

Establish an analytics strategy

Uneecops has business intelligence and data analytics consultants to help Fintech companies plan their analytics journey. We map challenges and strategize the end-to-end analytics software implementation.

Analytics software deployment

Analytics software deployment

We work with customers to assess their current business scenarios, processes, and readiness to embark on their automation journey. Our team manages business risks, detailing them with the best deployment options available.

Customizing analytics

Customizing analytics

We propose customized solutions to help fintech organizations manage their unique business challenges. Our team also discusses the benefits of analytics software, which helps businesses drive innovation and collaborate cross-department.

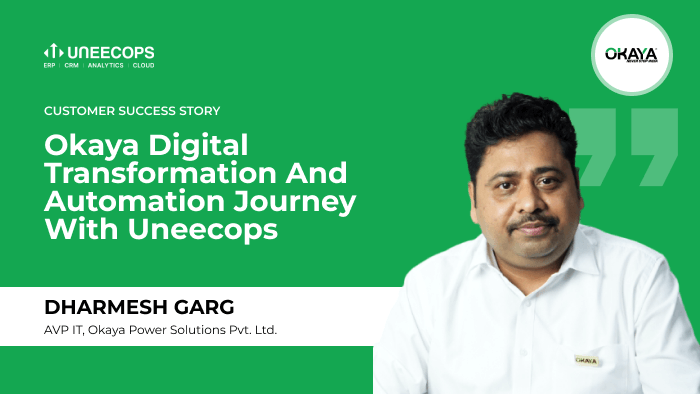

We Have the Best Partners to Drive Your Business

Our longstanding partnership with leading enterprise IT solution platforms enables us to deliver curated digital transformation services. Our diverse network of technology experts and consultants ensures that your business receives the most innovative and customized business enterprise solutions.

Read about our latest insights

Blogs

Want to know more

about Analytics?

Explore to dig deep to see how we help you build intelligent enterprises.