It’s been quite a decent time since GST e invoice was introduced and implemented, but many businesses are still facing hardships. While some businesses are keeping pace with the momentum, others still have to go a long way to ensure compliance and avoid heavy penalties. In addition, Government new rules which mandate businesses having a turnover of INR 50 Cr+ from 1st April 2021 necessitate the need of having a robust e invoicing gst solution in place.

In this blog, we will be discussing the top 5 commonly asked questions on E-invoicing GST returns.

Q- 1 What signifies GST Return?

As per the ClearTax, a return is a document containing details of income which a taxpayer is required to file with the tax administrative authorities. This is used by tax authorities to calculate tax liability.

Under GST, a registered dealer has to file GST returns that include:

- Purchases

- Sales

- Output GST (On sales)

- Input tax credit (GST paid on purchases)

To file GST returns or GST filing, GST compliant sales and purchase invoices are required.

Q- 2 Who should file GST Returns? How SAP Business One helps?

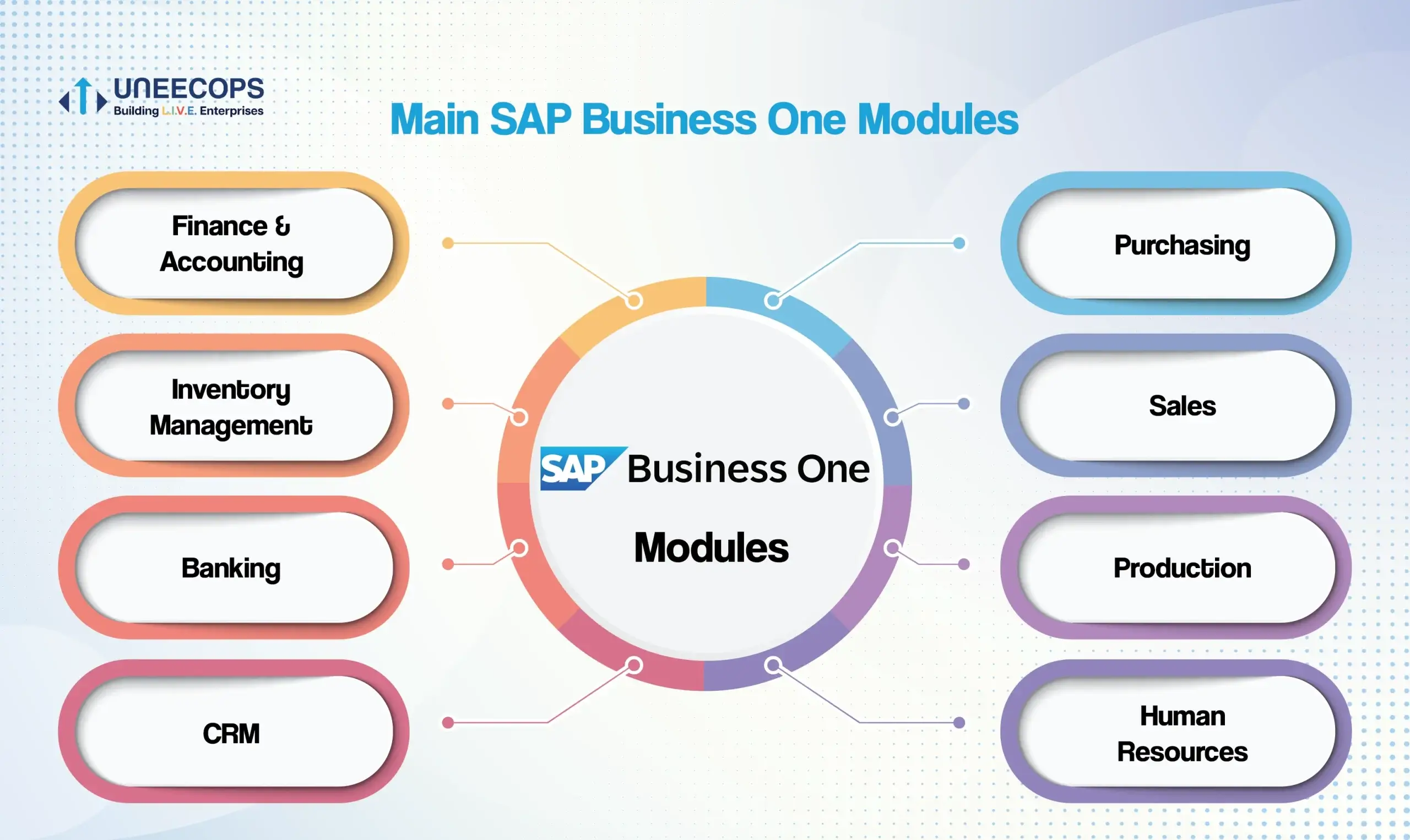

All business owners and dealers must file GST returns according to the nature of their business or transactions. SAP Business One when integrated with ClearTax automates the tax filing process and eliminates the scope of errors and risks. With e invoicing software, you can easily conform to the approved standards of the GST law. The software also removes the probabilities and delays while filing ANX-1/GST returns and part-A of the e-way bills.

Q-3 What is Non-Compliance of E-Invoicing?

- When an e-invoice is not issued to the buyer

- When eligible invoices are not reported to the IRP

As per CGST Rule 48(5), any invoice issued by an eligible taxpayer without the IRN is considered to be an invalid invoice.

Q-4 What are the consequences of Non-Compliance of E-Invoicing?

There could be dire consequences of non-issuance of invoice or incorrect invoicing such as-

Heavy Penalties

- You attract heavy penalties of up to Rs.10,000 per invoice.

- In addition, incorrect E-Invoicing could result in penalties of up to Rs.25,000

Impact on Customer Relations

- GST returns now get auto-populated from the e-Invoice system. Your customers’ GSTR-2A/2B statements will not reflect the Input Tax Credit (ITC) rightfully due to them.

- Non-issue of valid tax invoices could also result in your customers refusing to accept these invoices from you. As a consequence, you will be deprived of receiving payments for the goods you have supplied

Prevention of E-Way Bill Generation

- You cannot generate e-way bills without the IRN, as per the latest government regulation.

- Non-generation of e-way bills impact the movement of goods and lead to the detention of goods along with penalties being levied.

Q- 5 What is the key difference between Current Vs New GST Return Systems

Switch to GST Ready ERP

Confused with the old return filing and the new return filing process? Think new GST return is way complex and full of complex processes? It’s time to make smarter decisions and be GST-ready.

Avoid Last Minute Hassle

E-invoicing is mandatory for businesses having a turnover of INR 50 cr+ from 1st April 2021. Hence, the need for investing in an e invoicing software designed specifically for GST is all you need to ensure that you are following the latest GST norms.

*Implementation will take 2-3 weeks after project allocation. The time is to catch up and make the timely decision to Go-live for E-invoice to avoid last minute hassle and heavy penalties.

Schedule a demo today with our SAP certified experts and be GST compliant! To know more contact us on 1800-102-8685.