It is estimated that on an average 70% of finance teams still rely on spreadsheets to do their basic financial chores. This figure seems surprising but this is a fact that leading businesses are actively using spreadsheets to automate their daily accounting tasks and day to day financial reporting and operations. When businesses use spreadsheets, they often fall in the risk of poor visibility and less transparency, delay in managing all accounting processes, managing cash flow, banking, and reconciliation etc.

So, if there are risks associated with spreadsheets and excel sheets, then why do companies still cling on to them when there are other options available? Surely, decision-makers seem to have derived certain value from spreadsheets. Let’s talk about a few.

- Transparency: Even though spreadsheets may sometimes confuse business users and delay the process in decision making owing to multiple rows and columns, it may still be tempting to see the data and know about the figures from the traditional method.

- Accessibility: Any corporate user can easily access Google Docs or Excel whenever needed.

- User friendly: Most people are familiar with spreadsheets basics so it is considerably easier to use.

These pros carry considerable weight and hold the value proposition. But, there comprise a long list of cons too. The cons we heard from our customers include significant time lost by the finance team performing manual entries rather than strategic tasks, poor data management, delay in audit reviews, customer receivable reports and profit and loss statements. Further, business users also state their concerns over using spreadsheets which includes no big data support, no data integration or lack of speed to process critical information.

Replacing Spreadsheets with SAP Business One

There are many benefits of moving from Excel to an advanced business solution. Here are the top five benefits uncovered which help you decide why SAP Business One is the apt solution for FP&A departments.

1. Supporting one version of the truth

The smart business solution such as SAP B1 helps the finance team to stay agile and minimize the probabilities of errors. With an authentic source and a single version of truth, every finance professional is on the same page. This unified data helps all your team members to increase the likelihood of speed and integrity of information on what is being reported.

2. Performance maximized threefold

The modern solution promises threefold efficiency and performance of finance professionals. Since they are equipped with advanced technology and the business solution they can devote their time to more useful tasks that seek their attention. Further, the time saved by manual entries and assurance of no duplicate entries ensures the finance team stay well on performance track and close the books successfully and timely.

3. More time for financial planning

The enterprise-ready solution support finance experts to find more time for financial planning. They can do analysis faster and perform ‘what-if’ scenarios during budgeting and prediction cycles.

4. Speed calculation

A modern solution can do a lot better calculations than excel sheets or spreadsheets. It speeds calculations such as cell formulae, subtotals, variances, percentages and performs a host of other calculations thus saving tons of time.

5. Support business decisions

SAP Business One ensures deeper visibility into performance metrics. It lets the finance, planning and analysis team to support better business decisions. Furthermore, it is easier for the team to stay compliant with evolving regulatory requirements.

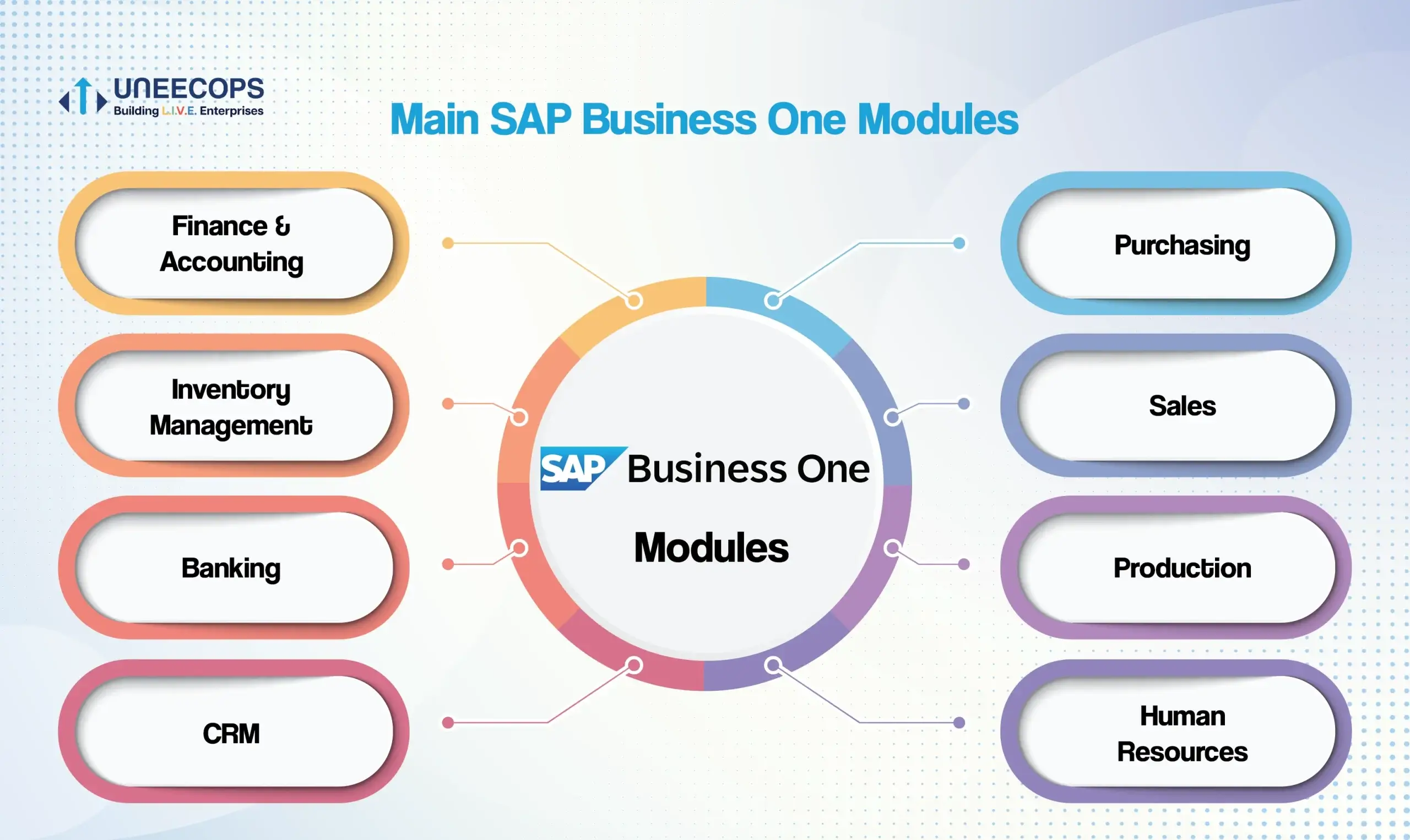

Encouraging people to think about Intelligent Finance

In this blog, we have highlighted five areas where SAP Business One is taking the lead over the most widely used tool Excel and spreadsheets. By investing in a robust business solution, they can minimize repetitive tasks, maintain the integrity of information, free up resources for strategic tasks, and significantly mitigate risk with unprecedented visibility. In simpler words, there is no need for the CFO or finance head to invest in a disparate system. SAP Business One effortlessly manages all vital functions of your business which includes finance, sales, administration, human resources, procurement, supply chain and many more.

Do you envision a smart era driven by technology? Do you perceive your finance team as strategic players? It’s time to make a move towards intelligent finance. Talk to our experts to make it happen.