Have you been lately hearing a lot about ‘E-invoicing’ or ‘electronic invoicing’ which is keeping you worried all day and night as how it will impact your business? Luckily, Uneecops a SAP Gold Partner offers a plugin to support GST e-invoice roll out. SAP Business One is a GST-Ready ERP that facilitates automated reporting of e-invoice to government portal and GST returns.

In the meantime, let’s refer to the introduction of e-invoicing for B2B businesses

What is GST E-Invoice?

‘E-invoicing’ implicates a system that authenticates all B2B invoices electronically by GSTN. Under the proposed electronic invoicing system, a unique identification number will be issued against every invoice. Invoice Registration Portal (IRP) will be validated through GSTN.

SAP Business One automates every process and eliminates the need for manual entry, the pile of paperwork and potential errors. With GST ready ERP, you can easily conform to the approved standards of the good and services tax (GST) Council. Therefore, it will eliminate the probability of glitches and delays while filing ANX-1/GST returns and part-A of the e-way bills.

How E-Invoice make compliance easier and benefit my business?

Businesses will reap the major benefits by using e-invoice generated by GSTN:

- E-invoice mitigates and remediates the major loopholes in data reconciliation under GST and reduces the possibility of mismatch errors and flaws.

- E-invoices, when generated can be read by another, allowing transparency and help mitigate any potential errors.

- Real-time tracking of e-invoices

- When you automate the tax return filing process, you can seamlessly generate the part-A of e-way bills.

- The relevant details of invoices would be auto-populated in filing other returns which saves time and efforts

- Reliability of genuine input tax credit.

- Lesser interventions of tax authority since the information is scanned at the transaction level.

What is GSTN’s e-invoicing initiative?

The Government’s intent to come with this new concept for ‘e-invoicing’ for GST in India was expected to be introduced from October. The GST Council, however, postponed it further to give time to all taxpayers to adjust it to the new format of filing GST.

SAP Business One will follow the most used standard across the globe – PEPPOL (Pan European Public Procurement Online) standard for invoice generation as set by the GST Council.

The system facilitates all businesses to exchange information about their trading and supply chain using a standard format. It enables a single data entry.

The GSTN’s e-invoice will constitute the below parts:

- E-invoice schema: It has the technical field name and details of sample values to fill in the detail.

- Masters: It comprises fields like State Code, invoice type etc.

- E-invoice template: The template enables readers to correlate the terms which are present in other sheets. Green are the mandatory fields while yellow are the optional fields.

When will E-invoicing get implemented?

The taxpayers with an annual turnover of over Rs 500 Crore can start e-invoices from 7 January 2020 voluntarily. Whereas, those with an annual aggregate turnover of over Rs 100 Crore can start e-invoicing from 1 Feb 2020. The electronic invoices will begin full-fledged from 1 April 2020.

What are the must-have fields of GST filing in India?

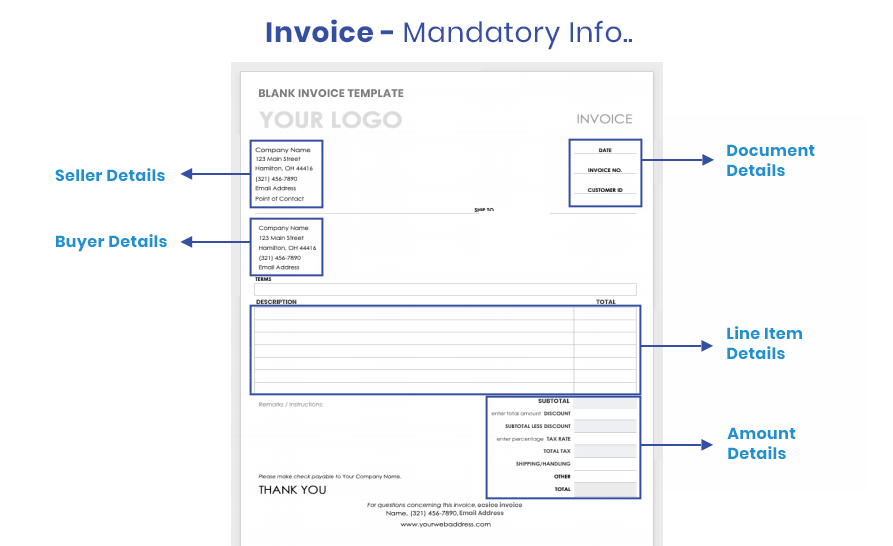

E-invoice must follow the GST invoicing rules. Many fields are made optional and users are required to fill relevant details only. Below is a quick glimpse of the content of e-invoicing.

There are 18 sections in total which consist of 133 fields. Out of 18, 8 are optional while the other 8 are mandatory.

In 8 Mandatory sections, you are supposed to fill 34 fields while 46 are kept optional.

In 10 Optional sections, you are supposed to fill 17 fields while 35 fields are optional

The following fields are the mandatory fields to be declared in an e-invoice:

| S.No. | Name of the field | List of Choices/ Specifications/Sample Inputs | Remarks |

|---|---|---|---|

| 1 | Invoice Type | Max length: 10Can be one of the following:Reg/SEZP/SEZWP/EXP/EXPWP/DEXP | Denotation for regular, SEZ supplies with payment, SEZ supplies without payment, deemed exports, sale from the bonded warehouse, export without payment of tax, export with payment of tax |

| 2 | InvoiceType Code | Max length: 50Will be auto-generated by GSTIN based on the invoice type specified by the user | A subcode may also be automatically added by the GSTN |

| 3 | Supplier_GSTIN | Max length: 15 Must be alphanumeric | GSTIN of the supplier raising the e-invoice |

| 4 | Invoice Number | Max length: 16Sample input is “ Sa/1/2019” | For unique identification of the invoice, a sequential number is required within the business context, time-frame, operating systems and records of the supplier. No identification scheme is to be used |

| 5 | Preceeding_Invoice_Reference | Max length:16Sample input is “ Sa/1/2019” | Detail of original invoice which is being amended by a subsequent document such as a debit and credit note. It is required to keep future expansion of e-versions of credit notes, debit notes and other documents required under GST |

| 6 | Invoice Date | String (DD/MM/YYYY) as per the technical field specification | The date when the invoice was issued. However, the format under explanatory notes refers to ‘YYYY-MM-DD’. Further clarity will be required |

| 7 | Reverse Charge | ‘Y’ or ‘N’ as a single character | Mention whether or not the particular supply is subject to reverse charge mechanism |

| 8 | GSTIN | Max length: 15 | The GSTIN of the buyer to be declared here |

| 9 | State Code | Max length: 2 | The place of supply state code to be declared here |

| 10 | Place | Max length: 50 | The place (locality/district/state) of the buyer on whom the invoice is raised/ billed to must be declared here if any |

| 11 | Pincode | Six digit code | The place (locality/district/state) of the buyer on whom the invoice is raised/ billed to must be declared here if any |

| 12 | Unique Identification Number | Abbreviated as ‘UUID’ Max length: 50Sample input is ‘649b01ft’ | A unique number will be generated by GSTN after uploading the e-invoice on the GSTN portal. An acknowledgement will be sent back to the supplier after the successful acceptance of the e-invoice by the portal |

| 13 | ShippingTo_GSTIN | Max length: 15 | GSTIN of the buyer himself or the person to whom the particular item is being delivered to |

| 14 | Shipping To_State | Max length: 100 | State pertaining to the place to which the goods and services invoiced were or are delivered |

| 15 | Supply Type | Max length: 2 Sample values can be either of Supply/export/Job work | It can be either interstate or intrastate supply. Further, it can be outward or inward supply Moreover, the supply can further be classified as import, export, job work, for own use, return, sales return, others, SKD/CKD/Lots, line sales, recipients not known, exhibition or fairs |

| 16 | Transaction Mode | Max length: 2The schema specifies that the field can have either of regular/bill to/ship to | A combination of a ‘Bill To Ship To’ and ‘Bill From Dispatch From’ is also allowed |

| 17 | Item Description | Max length: 300The sample value is ‘Mobile’The schema document refers to this as the ‘identification scheme identifier of the Item classification identifier’ | Simply put, the relevant description generally used for the item in the trade. However, more clarity is needed on how it needs to be described for every two or more items belonging to the same HSN code |

| 18 | Quantity | Decimal (13,2)Sample value is ‘10’ | The number of items (goods or services) that is charged on the invoice as a line item. |

| 19 | Rate | Decimal (10,2)Sample value is ‘50’ | The unit price, exclusive of GST, before subtracting item price discount, can not be negative |

| 20 | Assessable Value | Decimal (13,2)Sample value is ‘5000’ | The price of an item, exclusive of GST, after subtracting item price discount. Hence, Gross price (-) Discount = Net price item, if any cash discount is provided at the time of sale |

| 21 | GST Rate | Decimal (3,2)Sample value is ‘5’ | The GST rate represented as a percentage that is applicable to the item being invoiced |

| 22 | IGST Value, CGST Value and SGST Value Separately | Decimal (11,2)Sample value is ‘650.00’ | For each individual item, IGST, CGST and SGST amounts have to be specified |

| 23 | Total Invoice Value | Decimal (11,2) | The total amount of the Invoice with GST. Must be rounded to a maximum of 2 decimals |

How the e-invoice appear to be?

Switch to GST Ready ERP

Left awestruck by seeing all these fields? Wondering how you can file all your tax returns and stay compliant with new GST laws? There is no need to be worried about. With SAP Business One GST-ready ERP you can stay compliant as the ERP follows the PEPPOL (Pan European Public Procurement Online) standard for invoice generation as set by the GST Council.

Are you running a B2B business and want to deploy GST-Ready ERP for seamless filing of tax and runs as per the GST Council?

Limited time period offer:

Uneecops Business Solutions a leading SAP Business One gold partner is offering a limited time period offer on GST e-invoice plug-in for SAP Business One customers. To know more contact us on 1800-102-8685.

Schedule a demo today with our SAP certified experts and be GST complaint!