If you think financial management is still all spreadsheets and slow reporting, think again, SAP S/4HANA finance is changing the game in 2025.

Today, the world of finance is changing, and it is not just about the replacement of one system with another. It’s also not just about a financial control tool, it’s about fundamentally transforming how companies think about financial planning, operations, and reporting.

Finance teams are under more pressure than ever, and in 2025, SAP S/4HANA finance is helping them not just cope, but lead the charge. With underlying future-ready architecture, SAP S/4HANA finance is a smart finance solution helps to transform companies towards the digital age, by simplifying their financial operations and enabling companies to automate, streamline, and predict outcomes with unprecedented accuracy and agility.

Finance Rebooted: The SAP Way

In the SAP ERP ecosystem, the SAP Finance module has always been a strong application and with the advent of SAP S/4HANA, it has indeed transformed a lot. This module has been reimagined with state-of-the-art HANA in-memory database capable of sifting real-time data and providing all-new insights for CGOs and finance teams.

SAP Finance features for 2025 support integrated planning and forecasting, combine financial and management accounting to offers stronger risk management. This, in turn, lets organizations simplify their operations across divisions while preserving a single source of financial truth.

Advanced SAP Finance Features You Can’t Ignore

One of the key characteristics of SAP S/4HANA finance in 2025 is its rich set of new capabilities optimized for the increasing convolution of global finance. Key SAP finance features of SAP S/4HANA finance are:

- Universal Journal: Financial and management accounting in single line item table, hence it will avoid data duplication and maintain consistency in the report automatically.

- Predictive Analytics: Provides finance intelligence into future trends along with modelling of financials based on historical data.

- Real-Time Processing: Transactions and analytics run in parallel which means you get quick closing and immediate access to your KPIs in memory.

- Embedded AI and ML: AI is fuelling smarter automation decision-making, from fraud detection to expense management.

- Cloud Deployment: Option to install where you choose – on-premise installation, cloud installation, or a hybrid of the former options.

Taken together, these aren’t just shortcuts but unleashing forces that will take finance from a place-holder function practice to strategic, insight-driven support.

Read More:- The CFO Guide to SAP S/4HANA Finance

Automated Financial Processes in SAP: The Backbone of Efficiency

Automation forms the crux of the value proposition for SAP S/4HANA finance. Relying on SAP’s automation for financial processes operating in the digital age has brought huge cost savings to users and eliminated human errors for the following tasks:

- Invoice matching and payment administration

- Calculating depreciation of assets

- Revenue recognition

- Month and year-end close of financials

Automating these repetitive chores keep finance teams concentrated on strategy such as risk analysis and investment planning. The platform also combines intelligent workflows and alerts to guarantee real-time approvals and compliance requirements are achieved.

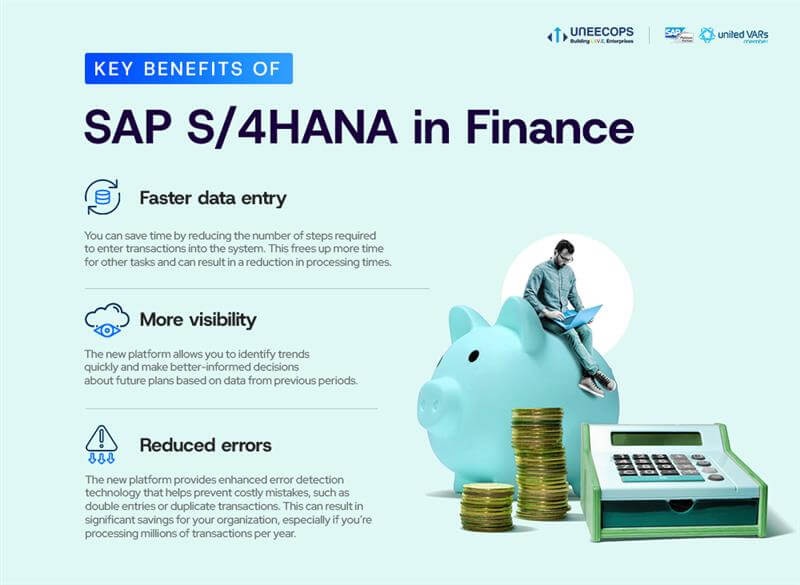

Streamlining Financial Reporting in SAP

Financial reporting in SAP has been a key requirement for any business. But SAP S/4HANA finance takes that a step further by providing great reporting software such as SAP Fiori and SAP Analytics Cloud. It’s now a cinch for users to create active, responsive reports that show financial health across every level of their organization.

This new standard of reporting can help customers adhere to regulations across multiple areas globally. It includes data states & quarters for period generations and intuitive dashboards that allow non-finance users to understand financial performance. Moving from static to real time, self-service reporting enables your teams to respond rapidly and confidently to the insights they receive.

SAP Finance Module for Businesses of All Scales

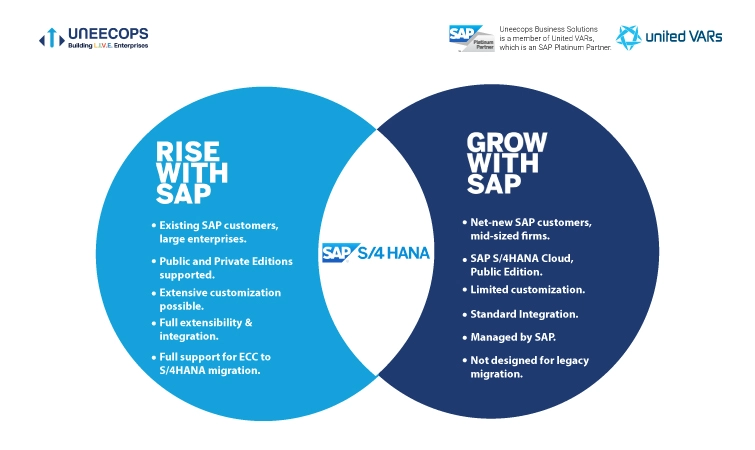

In 2025, SAP finance module is not only for big corporations any longer. With scalable cloud choices and industry-specific solutions, it’s not just large companies that are turning to SAP S/4HANA finance to simplify complexity and stay compliant. Businesses of all sizes are looking to leverage it.

Whether it is a global company dealing with international taxation or a SME looking for a tighter control of costs, the SAP finance module contains flexible functionality to suit any business type. Vertical-specific best practices built within the system make it even more user-friendly for verticals like manufacturing, retail, and professional services.

The Strategic Part Finance Plays in the Digital Era

Finance is no longer just a bookkeeping function. SAP S/4HANA finance has transformed the finance function into a driving force for strategic decision-making integrally driven by data. This evolution will be essential in 2025; businesses will be dealing with the acceleration of market shifts, raised levels of regulatory scrutiny, and the need for instantaneous responses.

Today’s finance leaders are trusted advisors to their line of business counterparts — working closely with other executives to provide guidance on business growth, technology investments, and procedural efficiencies using the tools we provide in SAP. The usefulness of the functionality of SAP finance module isn’t only limited to internal requirements, but also contributes essential support in determining the external competitiveness.

Final Thoughts

SAP S/4HANA finance is not just a financial system; it’s a driving force of transformation. It is reimagining finance for the year 2025 by embedding intelligence, enabling automation, and providing real-time insights. SAP is enabling finance professionals, from emerging firms to large corporations, to drive new levels of speed and intelligence, and to become more strategic.

As the digital economy becomes more sophisticated, those who are able to draw on the entire spectrum of SAP S/4HANA finance capabilities and automated financial procedures residing in SAP are likely to excel. Finance is not confined to back offices anymore – with SAP S/4HANA finance it is leading the way!

Evolve with Uneecops from traditional accounting services to next-gen finance system for unlocking enterprise value through digital transformation, the power of real-time data and a reimagined workforce. Uneecops, a SAP Platinum Partner and also a member of United VARs, help organizations in:

- Creating an overview by explaining functionalities, usage possibilities, and technical requirements associated with S/4HANA finance

- Better decision-making by choosing from various implementation options (e.g., Central Journal, Greenfield/Brownfield, etc.) and developing a customised S/4HANA Finance roadmap

- Evaluating your finance operating model, your tax and reporting requirements, or the level of compliance with technical requirements and functional arrangements

- Implementing on the basis of the roadmap decided