Finance industry’s business landscape is rapidly evolving and faces an array of challenges and opportunities on the go. Staying ahead of such a dynamic environment requires financial institutions to employ advanced technologies like SAP services that can help streamline operations, enable informed decision-making, and provide real-time insights for the same. SAP S/4HANA for finance industry is a cutting edge, intelligent, and integrated enterprise resource planning suite designed to revolutionize financial processes while driving business growth. SAP S/4HANA finance has been built on the powerful foundation of the SAP HANA in-memory database so that it can mark a pivotal shift from traditional transactional systems to a data-driven, real-time approach that promises unparalleled efficiency, accuracy, and strategic advantage.

SAP for finance industry caters to the finance industry’s unique needs, offering special functionalities for cost controlling, fixed asset accounting, cash management, and risk management, among many others. Such tailored capabilities ensure that financial institutions can efficiently optimize cost structures, mitigate risks, and comply with regulatory requirements.

SAP S/4HANA for finance industry emerges as a game-changing solution that empowers financial institutions to embrace the digital age confidently while making well-informed decisions that pave the way for sustained success in an increasingly competitive landscape. In this article, we will explore how SAP S/4HANA for finance industry empowers the finance industry for transformation, growth convergence, and innovation seamlessly.

For many CFOs, deciding when and how to implement SAP S/4HANA could be the most significant technology investment choices of their career. They are always figuring out answers of some of these questions,

- What is so different and better about SAP S/4HANA?

- Factor of consider SAP S/4HANA

- Are we ready to deploy it in our systems?

- What is available SAP S/4HANA Deployment Options?

Here is some overview on S/4HANA Finance which can be the answer of above questions. If not, stay tuned to our S/4HANA Finance specific write ups to know more!

Read more – Finance ERP for Better Profitability: A Futurist CFOs Best Bet

1. Harness the potential of advanced analytics and real-time insights with SAP S/4HANA finance.

Financial institutions must harness the power of cutting-edge technologies in the quest for sustainable growth and success, such as SAP S/4HANA finance. It seamlessly integrates advanced analytics and real-time insights to provide unparalleled precision and agility.

SAP S/4HANA for finance industry can fuel the path to excellence by helping financial institutions realize the potential of advanced analytics. It goes beyond the traditional ERP systems by offering a powerful platform that enables financial businesses to delve into the potential of their data effortlessly. Finance companies can leverage sophisticated analytics capabilities to:

- Identify hidden patterns

- Drive smarter strategies

- Identify correlations

- Reveal new growth opportunities

- Identify trends

SAP S/4HANA finance revolutionizes the traditional data analysis approach of arduous and time consuming statistical processing and maintenance with its in-memory computing capabilities while delivering lighting-fast data processing and evaluation. Financial businesses can gain a comprehensive understanding of their performance, customer behavior, and market trends with the power of SAP S/4HANA for finance industry.

2. Unleash integrated financial planning and financial excellence with advanced analytics through SAP S/4HANA for finance industry.

SAP S/4HANA for finance industry offers integrated financial planning and analysis as a transformative approach to financial management, further empowering teams to optimize planning processes and make informed decisions.

A key benefit of such integration of SAP services is the ability to create comprehensive financial plans that encompass all aspects of an organization’s financial activities to consequently forecast future performance. It helps them leverage real-time data to:

- Build holistic and accurate plans

- Ensure the alignment of plans with the company’s financial goals

- Establish a unified view of financial data

- Help stakeholders gain valuable insights into the organization’s financial health

- Identify potential areas for growth and improvement

SAP S/4HANA for finance industry takes financial planning to the next level, thus achieving financial excellence with sophisticated data analysis to uncover trends, correlations, and patterns for ensuring financial plans and budgets grounded in accurate projections and realistic assumptions. Additionally, it gives them the power to take a proactive approach towards better plans for contingencies, risk assessment, and capitalization on emerging opportunities.

3. Strengthen financial resilience with empowered treasury and risk management through SAP S/4HANA for finance industry.

Managing financial risk and complying with regulatory requirements is critical for organizations that aim to maintain stability while achieving sustainable growth. SAP S/4HANA for finance industry offers integrated modules for treasury and risk management to transform the way finance teams navigate complex financial landscapes with the help of comprehensive tools that help:

- Effectively manage risk exposure

- Optimize financial instruments

- Devise hedging strategies

SAP S/4HANA for finance industry equips teams with the necessary tools to identify, assess, and mitigate financial risks proactively. Decision makers can leverage the real-time access to critical financial data to stay ahead of market fluctuations, currency risks, and interest rate fluctuations along with commodity price chances to safeguard the organization’s financial health.

Additionally, SAP S/4HANA finance helps with sophisticated analytics and data integration to assist treasury functions with a holistic view of financial positions that allow strategy and execution of hedging activities with precision. Effective management of foreign exchange risk and commodity price volatility helps businesses protect their profitability to maintain financial stability even in turbulent economic conditions.

SAP S/4HANA for finance industry ensures regulatory compliance with robust functionalities that effortlessly generate accurate and timely reports to help organizations adhere to stringent financial regulations and reporting standards. Paired with continuous monitoring of risk exposure across the enterprise, teams achieve a high level of accuracy, responsiveness, and flexibility to adapt swiftly to unforeseen uncertainties and ensure excellent treasury and risk management.

Whatever challenge you face, Uneecops is there to help

SAP S/4HANA for finance industry emerges as a transformative force that empowers the world of finance with a comprehensive and integrated solution to thrive in today’s dynamic and challenging business environment. Embracing the SAP S/4HANA cloud signifies commitment to driving innovation and growth in the finance industry, further ensuring a path to financial excellence and sustainable success. SAP S/4HANA finance offers limitless possibilities and acts as a catalyst in transforming the industry with enhanced financial insights, resilience, and agility. SAP S/4HANA for other industries can also be an incredible turning point, with SAP solutions like SAP S/4HANA for manufacturing and SAP S/4HANA for automotive.

Uneecops help CFOs in harnessing SAP technologies for transforming Finance. We believe in choosing clarity over chaos, through a safe reliable approach that maximizes agility while minimizing disruption. With SAP S/4HANA, we help move your finance function to the cloud fast, and empower CFOs by replacing fragmented data and disparate systems with a single, central source of truth.

Here’s how Uneecops supports you in the bringing Next Gen SAP S/4HANA For Finance – an evolved function into your systems

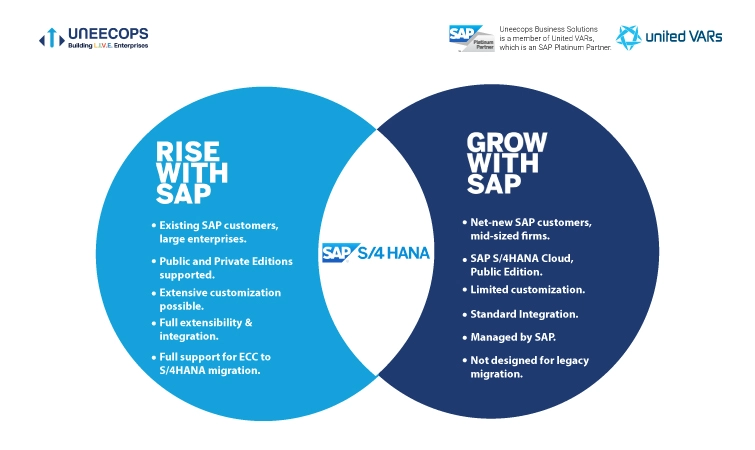

Evolve with Uneecops from traditional accounting services to next-gen finance system for unlocking enterprise value through digital transformation, the power of real-time data and a reimagined workforce. Uneecops, a SAP Platinum Partner and also a member of United VARs, help organizations in:

- Creating an overview by explaining functionalities, usage possibilities, and technical requirements associated with S/4HANA Finance

- Better decision-making by choosing from various implementation options (e.g., Central Journal, Greenfield/Brownfield, etc.) and developing a customised S/4HANA Finance roadmap

- Evaluating your finance operating model, your tax and reporting requirements, or the level of compliance with technical requirements and functional arrangements

- Implementing on the basis of the roadmap decided

To discuss further on your specific business requirements please feel free to connect with Team Uneecops and allow us to Evaluate Your Finance Process Requirements!