Tax is taxing. But it is the time of the year when we start talking tax returns. For FY24-25, the last date of income tax return filing is 31st July 2024 and the due date of tax return filing for domestic companies is 31st October 2024. While it is a simpler process for filing income tax returns, companies need to employ an army of tax personnel to compute and comply.

It is a time when sweat droplets trickle down the face of every business CFO and individual taxpayer. Over the years, continuous and sustained efforts have been made to digitize the entire interface between taxpayers and the administration to combat tax complications and compliances. This is evident from recent changes such as e-invoicing, GST digitalization, the New Income Tax portal, faceless assessments and appeals, the Annual Information Statement (AIS) and Taxpayer Information Summary (TIS), and the Invoice Registration Portal (IRP), among others. This paradigm shift has helped leapfrog data collection and reporting accuracy and enhanced the overall taxpayer experience.

Let us see how technology-powered systems like SAP S/4HANA Cloud, an intelligent ERP system with an in-built SAP finance module, enable better tax compliance!

Challenges in Tax Compliance

Tax compliance has evolved significantly over the past few years, driven by the need for tax authorities and organizations to become more data-driven and event-based, as highlighted by the Organisation for Economic Co-operation and Development in the publication called Tax Administration 3.0: The Digital Transformation of Tax Administration ([OECD20]). The classic tax process before 20215, which once involved separate and disconnected compliance efforts at the end of a period, is now transitioning to real-time, data-centric systems. Tax authorities worldwide increasingly demand detailed digital data, often requiring electronic submissions of transactional data. This shift is accompanied by a rise in data mining and analytic techniques tax authorities use to ensure compliance and identify industry patterns.

As a result, organizations face challenges in adapting to these new requirements. They must now submit more detailed reports more frequently, including additional operational details like bank statements and fixed assets. Furthermore, the technical aspects of tax reporting have become more complex, with various data formats such as XML, PDF, and JSON becoming standard. Compliance now requires specific APIs for submitting returns, and these requirements vary widely between countries, posing additional challenges for organizations operating internationally.

In anticipation of the future of tax administration, there is an increased emphasis on enhancing processes across various business functions, including finance and tax, with technology playing a pivotal role. As businesses grow and adapt to changing regulatory landscapes, adopting innovative technologies becomes imperative for maintaining compliance and optimizing tax processes.

The key to a successful tax function in the future lies in the adoption of technologies that adhere to consistent design principles. These principles enable the automation of all aspects of tax legislation, including validations, computations, compliances, and reconciliations, on a unified platform.

Role of SAP S/4 HANA Cloud and Finance Module in SAP for Tax Compliance

SAP offers a comprehensive solution for systematically checking transactions and centralizing remediation activities. The SAP S/4HANA Cloud application integrates finance automation to expedite audit-proof corrections, ensuring compliance with new digital mandates. With an enterprise-wide repository of tax controls and automated screening of all tax-relevant transactions, it supports audit-proof corrections on a single, centralized platform.

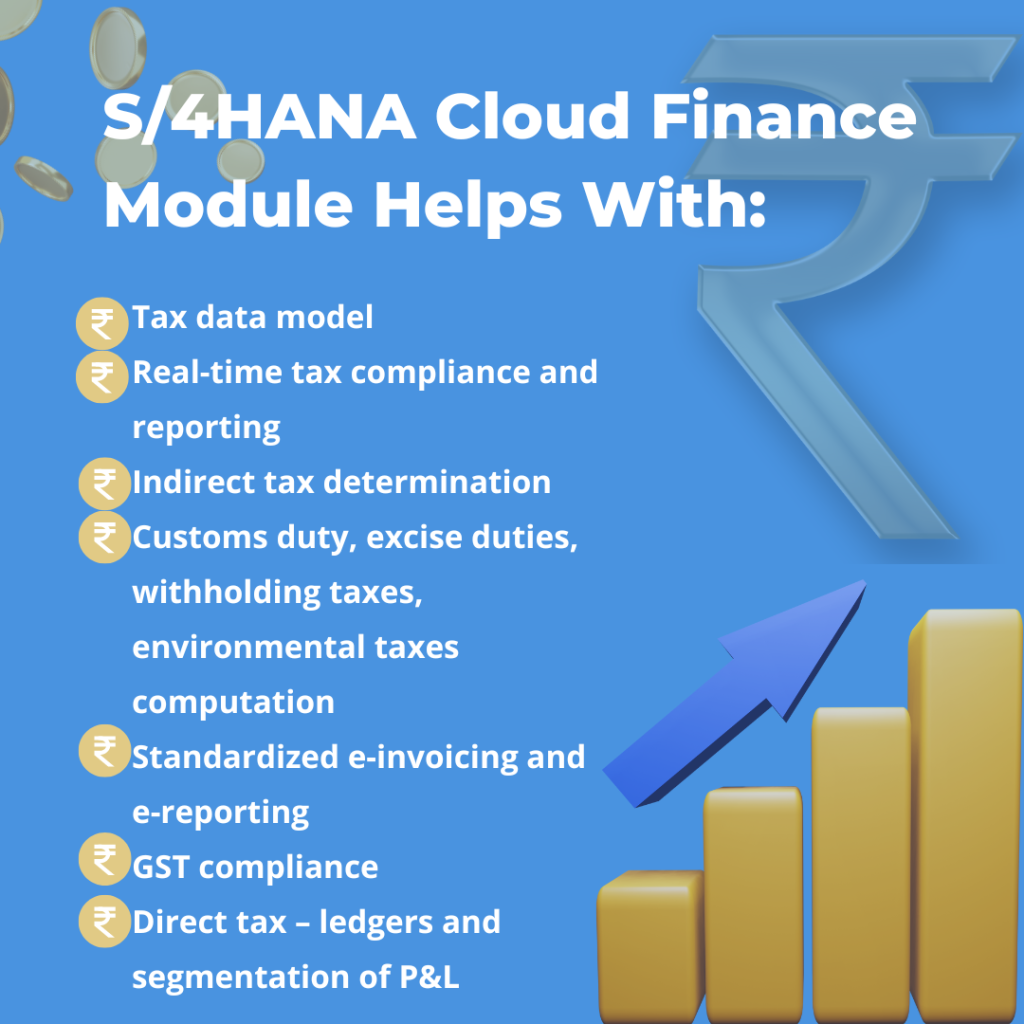

S/4HANA Cloud has a finance module in SAP that helps with:

Before we move ahead, let us see an interesting comparison of HANA vs without HANA TCO (total cost):

| Factor | Without HANA | With HANA (S/4HANA Cloud) |

|---|---|---|

| Manual Processes | High | Low (automated) |

| Data Integration | Complex | Streamlined |

| Reporting Efficiency | Low | High (automated) |

| Error Rate | High | Low (embedded tax engine) |

| Consultant Dependence | High | Low (increased self-reliance) |

Factors Affecting Total Cost of Tax Compliance: Breakdown Components

SAP HANA significantly lowers the overall TCO of tax compliance by eliminating manual tasks, improving data accuracy, and reducing reliance on external consultants. Understanding the breakdown of TCO is crucial for identifying areas for improvement:

- Internal labor costs: Manual data entry, calculation errors, and report generation consume valuable employee time.

- External consultant fees: Complex tax situations often require consultants to navigate regulations and ensure compliance.

- Technology costs: Maintaining and updating legacy tax software adds to the overall expense.

- Penalties and fines: Errors in tax filing can lead to hefty penalties and fines.

To lower the TCO, the SAP finance module comes into play. SAP S/4HANA Cloud has an SAP finance module that enables businesses to file corporate tax returns within budget and on time.

What Are the Benefits of Real-time Tax Compliance with S/4HANA Cloud?

With HANA Cloud’s SAP module for finance, data, process, and tax determination, improvements result in minimal human intervention. Implementing SAP S/4HANA is a once-in-a-decade opportunity to set the foundation for compliance rights. Key features include:

- Simplified master data: A single business partner can have multiple roles, improving data accuracy and tax determination.

- Standardized account determination: A complete chart of accounts template ensures detailed reporting and compliance.

- Future-proof tax setup and controls: Configurations for sales, purchases, withholding tax, and controls are optimized for compliance by design.

- Real-time insight: The HANA database enables transactional and analytical processing in one system, eliminating the need for data replication and enhancing data accuracy.

- Cost-saving: Automation reduces total compliance costs by 40-60%, achieving compliance by design. This means reduced time and cost in the reporting and filing process.

SAP S/4HANA offers native tax determination capabilities and the SAP Tax Service, providing flexibility, centralization, and user-friendly interfaces. While external tax engines offer benefits, they come with additional costs and complexities.

What are the things to consider before SAP S/4HANA Cloud implementation?

With the deadline for SAP ECC support ending in 2027, there’s never been a better time to switch to SAP S/4HANA Cloud Finance. By making the switch, businesses can take advantage of a modern, cloud-based, intelligent ERP platform that offers enhanced capabilities for tax administration and corporate tax return filing.

SAP’s Roadmap for Enhancing Tax Functionalities in S/4HANA

SAP is continuously investing in enhancing tax functionalities within the S/4HANA Cloud. Here are some anticipated areas of focus:

- Advanced analytics: Leverage IoT and machine learning for tax data analysis and risk identification.

- Global tax compliance management: Support for an even wider range of international tax regulations.

- Integration with third-party solutions: Streamline tax data exchange with external systems.

Stay updated on the latest developments to ensure your tax compliance processes remain optimized and future-proof.

The Future of Tax Compliance with SAP S/4 HANA Cloud Finance and AI

Nowadays, all companies can strive for advanced technological solutions to revolutionize their corporate tax compliance and reporting processes. By embracing a comprehensive and integrated SAP S/4HANA Cloud finance module, businesses can streamline reconciliations and ensure consistency across various tax filings, including GST, TDS, TCS, faceless assessments, and litigation management.

The emergence of Generative AI and Business AI further presents a groundbreaking opportunity to transform the corporate tax compliance lifecycle. Leveraging robust data processing and reconciliation technologies, AI can interpret intricate tax rules and logic by rapidly analyzing large volumes of data, providing precise insights. A sophisticated data extraction and mapping strategy can significantly reduce manual data processing, research, and analysis efforts. By automating rule-based processes, AI enhances accuracy and liberates valuable time and resources, enabling organizations to focus on strategic tax planning and decision-making.

Prepare for Future-ready Tax Administration and Corporate Tax Return Filing with Uneecops

A tax-informed design of SAP S/4HANA can slash operating costs, ease employee burdens, and reduce the company’s overall tax load, culminating in exceptional value delivery for your project. Your tax team might also identify additional savings by optimizing sales and using tax strategies.

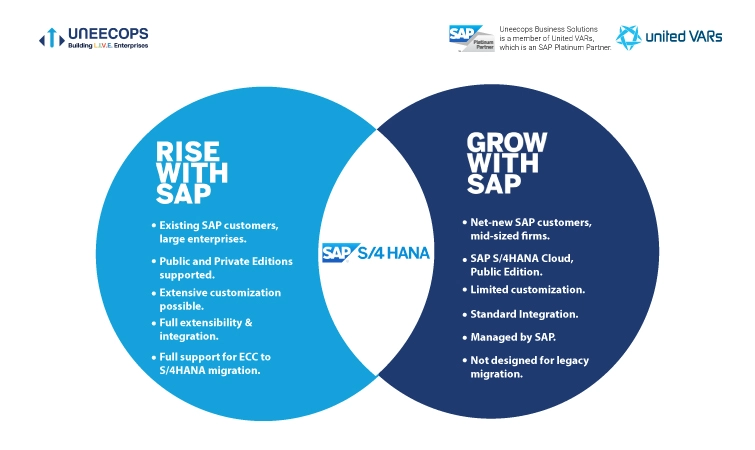

Uneecops’ SAP S/4HANA Cloud Finance services are designed to help businesses streamline their tax processes, enhance compliance, and stay ahead of regulatory changes. Uneecops is a member of United VARs, which is an SAP Platinum Partner.

With Uneecops’ SAP S/4HANA Cloud finance services, businesses can

- Simplify tax administration with automated workflows and real-time data insights.

- Stay compliant with the latest tax regulations and reporting requirements.

- Reduce manual efforts and errors with automated tax processes.

- Stay ahead of regulatory changes and adapt quickly to evolving tax environments.

At Uneecops, we ensure seamless integration and optimal functionality of your tax operations throughout every phase of SAP S/4HANA Cloud implementation. We do it in a phased manner:

Before implementation: We analyze your current tax operations, map data sources and targets across the tax lifecycle, and develop a target operating model and roadmap for tax.

During implementation: We incorporate tax requirements into the SAP finance module design, developing functionality that aligns with evolving Indian and global tax rules.

After implementation: We manage the tax team’s transition to the new system and assist with the finance module in SAP’s go-live process.

The key is to begin early, partner with an SAP S/4HANA Cloud partner, and embed tech into your workflows to automate tax and corporate return filing. As 31st October 2024 approaches and you prepare for the tax return filing deadline, remember to take a strategic leap with cloud technology and ERP transformation to enable greater speed, flexibility, innovation, and cost-efficiency.