The initial date for filing GST invoicing was supposed to be rollout on April 1, 2020, but due to an unprecedented situation, it has been revised further and extended till October 1, 2020, as the revised date for the implementation of e-invoicing. The Centre is affirmed with its decision to make GST-invoicing mandatory for businesses with an annual turnover of over Rs 500 crore for their business-to-business (B2B) transactions.

Industry representatives, however, have urged the Government to rather make it as voluntary compliance.

Small businesses however would breathe a sigh of relief and respite as the earlier plan to file GST-invoicing has risen from Rs 100 crore to Rs 500 crore. This has certainly brought great news for all small businesses as per the decision of the honorable panel of the Goods and Services Tax (GST) Council.

The website of Good and Service Network lays out the many benefits of “e-invoicing” and how it has a series of benefits for businesses such as standardization, interoperability, auto-population of invoice details into GST return and other forms (like an e-way bill), reduction in processing costs, reduction in disputes, improvement in payment cycles and thereby improving overall business efficiency.

Further, you can simplify the process of cumbersome reconciliation, indirect reconciliations, multiple levies and other indirect taxes.

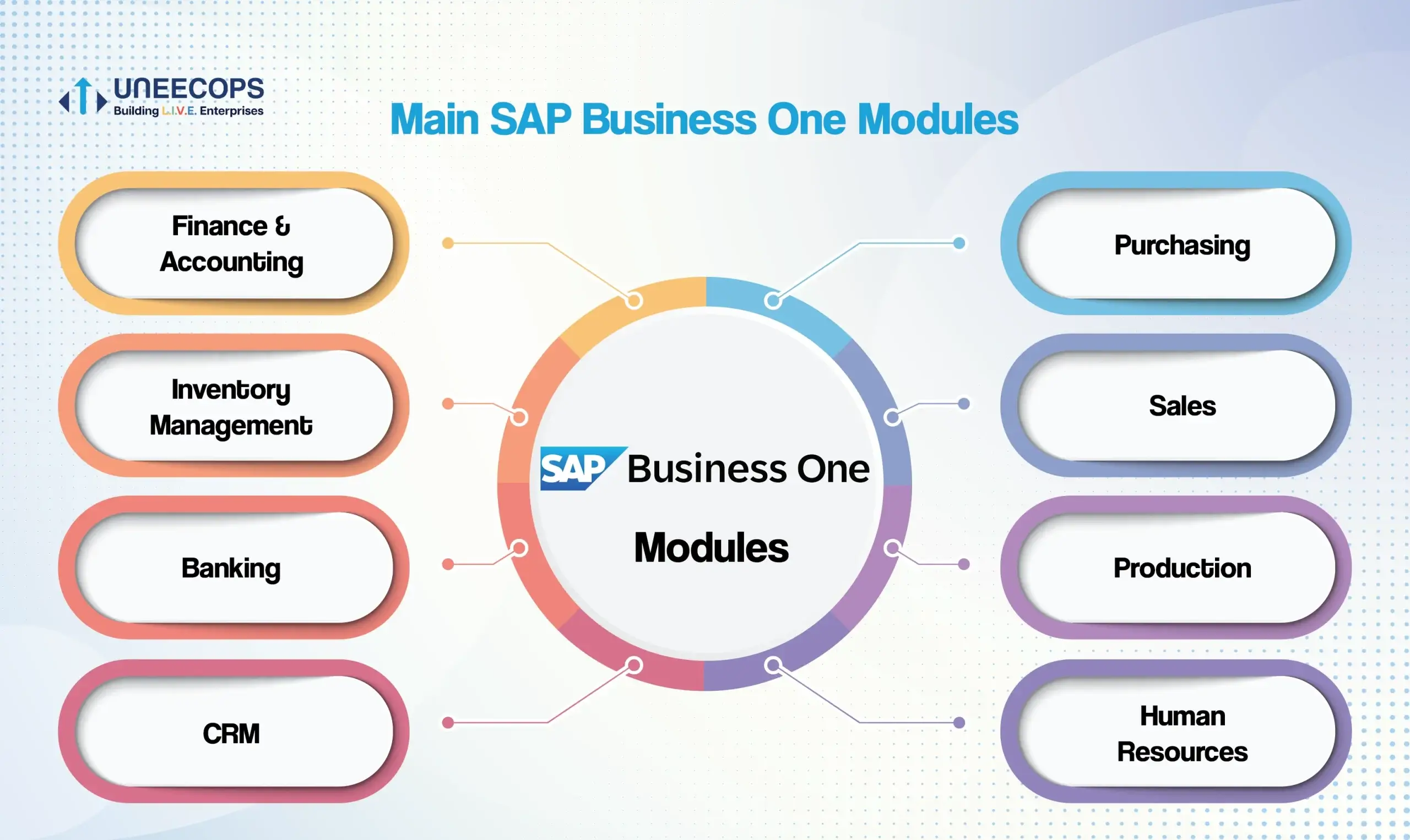

With such benefits there comes the opportunity and responsibility to go in the right direction. SAP Business One ensures that.

“Simplify cumbersome GST compliances with SAP Business One”

SAP Business One is a GST-Ready ERP with e-Invoice Integration

| Document Management: Easy-to-use, affordable and enterprise-level software to make document management related to statutory compliances, notices, payments, transaction-level data upload, numerous reconciliations and returns relatively easier and hassle-free. | Data Security: Robust, secure, scalable and enterprise-ready ERP software to run your business safely and in compliance with Goods and Services Tax. |

| Compliance Ready: Increase control of operations and transparency with a thorough view of all compliance activities and corporate governance. |

Business Standardization: Modern integrated ERP for data standardization and viewing year-over-year comparisons & forecasts for GST driven compliance. |

In case, you want to dive deep and know what GST e-invoicing is all about? Let’s refer to our previous blog and a few vital details?

What is GST E-Invoice?

‘E-invoicing’ implicates a system that authenticates all B2B invoices electronically by GSTN. Under the proposed electronic invoicing system, a unique identification number will be issued against every invoice. Invoice Registration Portal (IRP) will be validated through GSTN.

SAP Business One automates every process and eliminates the need for manual entry, the pile of paperwork and potential errors. With GST ready ERP, you can easily conform to the approved standards of the good and services tax (GST) Council. Therefore, it will eliminate the probability of glitches and delays while filing ANX-1/GST returns and part-A of the e-way bills.

How the e-invoice appear to be?

Switch to GST Ready ERP. SAP Business One Today!!!

Is ‘E-invoicing’ or ‘electronic invoicing’ keeping you awake all day and night as how to go about it and file it correctly? Wondering how you can file all your tax returns and stay compliant with new GST laws? Pass on all our worries to this smart and GST ready software and Uneecops as your SAP Business One partner. With SAP Business One GST-ready ERP you can stay compliant as the ERP follows the PEPPOL (Pan European Public Procurement Online) standard for invoice generation as set by the GST Council.

Schedule a demo today with our SAP-certified experts and be a GST compliant! To know more contact us on 1800-102-8685.