Some worried, some confused, many puzzled and almost all looking for better solutions. There is complete hustle and bustle in the minds of QuickBooks users. It’s been a decade, and now software company ‘Intuit’ has discontinued its offering in India. A popular financial and business management software for small businesses, QuickBooks will no longer be available from April 30, 2023. The exit announcement came in a few days ago when digitization has become a need of the hour for SMEs. User start looking alternative of QuickBooks now a days.

The Update: QuickBooks users can no more subscribe in India for QuickBooks Online, QuickBooks mobile app, QuickBooks Online Accountant and QuickBooks Time. Those who subscribed will receive a refund for the unused portion of their subscription. The current paid users will be converted to free users before July 31, 2022, to enable them to continue using QuickBooks until April 30, 2023, without any charges.

QuickBooks’ array of offerings includes cloud accounting, inventory management, invoicing and cash flow management. There was also an online practice management solution for CAs via QuickBooks Online Accountant. For an effortless experience, QuickBooks also launched a GST-compliant version of its online accounting offering in 2017.

Now, the curious question: What are the reasons for QuickBooks shutdown?

As per the official statements Intuit gave, there are no specific explanations for the QuickBooks shutdown decision. There are no considerations that inform us of the reasons for QuickBooks shutdown, except the announcement: “Upon careful consideration, it was decided that we can no longer deliver and support QuickBooks products that cater to the needs of SMEs and accounting professionals across India.”

A Big Blow for Users. An Opportunity for Competitors!

The first blow for small businesses was the pandemic. Post-pandemic, SMEs began to automate their business processes and pursue accounting operations in real-time. Many started using the QuickBooks accounting software.

Now, the bigger blow for such small businesses is the news of the shutdown.

But, when one door closes, a new opportunity and possibility come up.

The good news is that many Indian companies, such as SaaS startups, Zoho and Tally have come to the rescue of QuickBooks users.

From digital bookkeeping to accounts payable, inventory, and delivery, SMEs are collaborating with SaaS startups to continue accounting automation. Such companies can potentially increase their market share multi-fold in the coming times.

Another Sigh of Relief: ERP

While SMEs look for an alternative of QuickBooks, ERP is a great consideration. ERP software maximizes efficiency by integrating business functions on a real-time platform. It provides users, managers and leaders with the tools they need to make more accurate predictions. This software is a central hub for all the data or information that departments need to maintain daily. ERP platforms can update in run time, improving data accuracy and consistency.

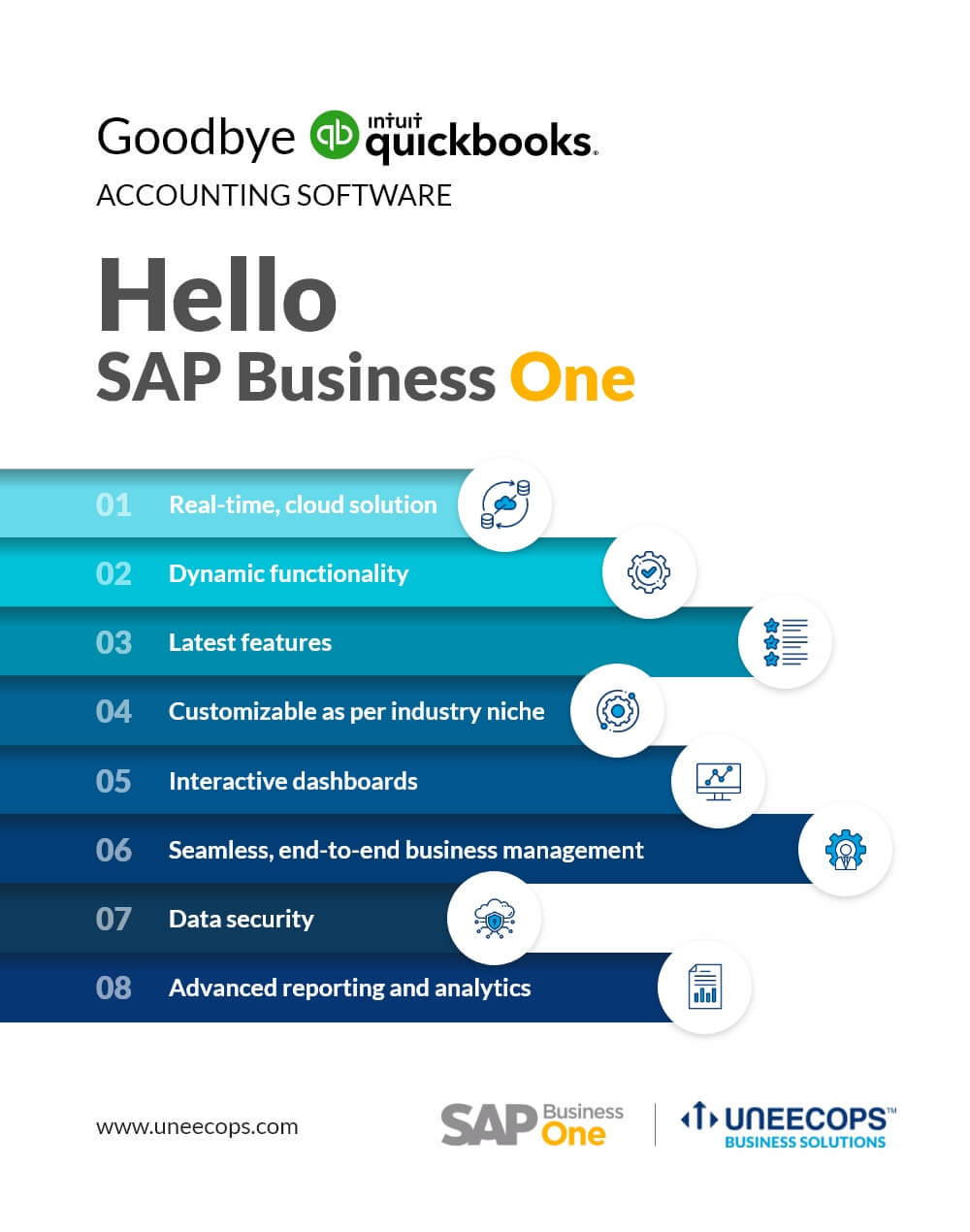

SAP Business One is an Alternative of Quickbooks

So, QuickBooks Users! Now, you can continue your accounting and financial operations.

Transition Smoothly with SAP Business One: Cloud-based, all-in-one, affordable ERP software with an accounting automation module

SAP is an established, worldwide market leader in enterprise application software. Its offering SAP Business One streamlines financial operations and improves visibility into cash flows. It allows you to increase the speed of transactions and digitize core accounting processes such as journal entries, cash flows, accounts receivable and accounts payable.

There are more benefits of choosing SAP Business One – beyond mere accounting and financial automation.

Last but not least, when the times are tough, a fruitful partnership can sail you through!

Uneecops Business Solutions (UBS) understands how challenging it can be to find QuickBooks alternatives for small business. We will be glad to serve the requirements of those businesses looking for a QuickBooks alternative. The new partnership and SAP Business One implementation will provide QuickBooks users with a seamless, simplified accounting experience that helps focus on what is important instead of juggling different software platforms. Customers can now manage customer invoices, accounts and books on the cloud ERP platform – saving a lot of time, money and reducing the likelihood of errors.

UBS supports business end-to-end. We work with you to eliminate silos and unify your accounting function with all other departments – inventory, supply chain, finance, HR, CRM and more. With SAP Business One implementation, technical and managed services support, we don’t just offer an alternative of QuickBooks; we provide the ultimate solution to improve business efficiency and profitability.

If you are still on the fence about choosing a QuickBooks alternative, we completely understand. There is nothing better than having a real-life demo of how SAP Business One can solve your comprehensive business challenges. We would like to walk you through the solution and share some use cases.

Get ready to build an intelligent enterprise. Take the lead in your industry and request a SAP Business One demo now!